Celebs Who Invested in Failed Startups

The intersection of Hollywood and Silicon Valley has led to numerous high profile investment ventures over the last two decades. While many celebrities have found immense success in the tech world others have seen their capital vanish in ambitious projects that failed to find an audience. These failed startups range from social media platforms and cryptocurrency exchanges to short form streaming services and themed restaurant chains. Understanding these financial missteps provides a unique look at the risks inherent in venture capital and brand endorsements.

Leonardo DiCaprio

Leonardo DiCaprio was one of the earliest high profile backers of the photo and video sharing app known as Mobli. This startup aimed to compete directly with Instagram by offering unique visual filters and real time search capabilities based on locations. Despite securing millions in funding from various sources the platform struggled to retain a significant user base in a crowded market. The company eventually pivoted several times before its technology was sold for a fraction of its peak valuation. This investment serves as a prominent example of how star power cannot always overcome established social media giants.

Justin Bieber

Justin Bieber invested heavily in a selfie centric social media application called Shots of Me which later became simply Shots. The platform was designed to reduce online bullying by removing public comment sections and like counts on photos. While the app initially saw a surge in downloads due to the involvement of the pop star it failed to maintain long term engagement. The company eventually transitioned into a production studio for digital content creators after the social app was discontinued. This move marked a significant shift from their original goal of creating a safe social networking environment.

Gisele Bündchen

Gisele Bündchen took on a role as the head of environmental and social initiatives for the cryptocurrency firm FTX as part of her investment deal. She was featured in high budget advertising campaigns alongside her husband to encourage mainstream adoption of digital assets. The subsequent bankruptcy of the exchange wiped out her significant equity position in the company. Legal proceedings followed the collapse as investors sought to hold celebrity promoters accountable for their roles in marketing the platform. Her involvement highlighted the trend of supermodels leveraging their global reach to enter the world of financial technology.

Stephen Curry

Stephen Curry signed a long term partnership with the digital asset exchange FTX that included an equity stake in the company. He promoted the platform through various social media channels and appeared in several lighthearted commercials. The sudden downfall of the company during the crypto market crash led to the total loss of his investment. Like other celebrity endorsers he faced scrutiny and legal challenges following the revelation of the firm’s internal practices. This venture illustrated the high volatility and risk associated with the emerging cryptocurrency sector.

Shaquille O’Neal

Shaquille O’Neal was an early celebrity partner for FTX and frequently appeared in promotional material for the exchange. He utilized his massive public persona to bring attention to the platform through both digital content and live appearances. The total collapse of the firm meant that his equity stake disappeared overnight as the company entered bankruptcy. He later distanced himself from the project as legal battles regarding the promotion of unregistered securities intensified. This situation serves as a cautionary tale for athletes looking to diversify their portfolios through emerging tech startups.

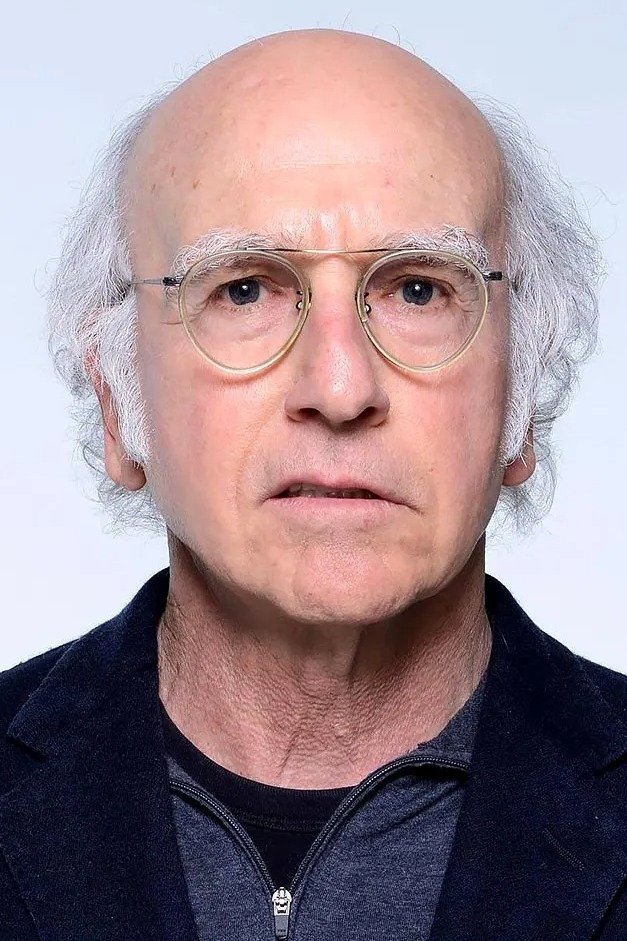

Larry David

Larry David starred in a high profile Super Bowl commercial for FTX where he played a skeptical character rejecting historical innovations. This appearance was part of a larger compensation package that included a financial stake in the cryptocurrency exchange. When the company filed for bankruptcy the value of his investment plummeted to zero. The commercial ironically became a viral sensation for its accurate depiction of skepticism in the face of the subsequent market crash. This instance showcased how even ironic or humorous celebrity endorsements can have serious financial consequences.

Lady Gaga

Lady Gaga was a founding partner and major investor in the social networking startup Backplane. The goal of the platform was to help celebrities and brands build dedicated communities for their most loyal fans. Despite raising significant capital and launching the successful LittleMonsters.com community the company struggled with high operational costs and internal management issues. Backplane eventually ran out of funding and was forced to sell its assets to another firm. The failure of the project demonstrated the difficulties of scaling niche social networks even with a massive built in audience.

MC Hammer

MC Hammer attempted to enter the search engine market by launching a specialized platform called WireDoo. The service was intended to provide deep search results that focused on the relationships between different topics rather than just direct keywords. Although the project generated significant buzz during its announcement at a major tech conference it never fully materialized as a viable competitor to Google. Technical hurdles and a lack of continued funding led to the quiet dissolution of the project. This venture reflected the rapper’s long standing interest in technology and digital innovation despite its commercial failure.

Will.i.am

Will.i.am founded the technology company I.am+ which focused on high end consumer electronics including smartwatches and headphones. The company launched several products like the Puls smartwatch which received mixed reviews and failed to gain market traction. Despite raising over one hundred million dollars from investors the firm struggled to compete with established giants like Apple and Samsung. Eventually the company shifted its focus toward enterprise artificial intelligence software after the hardware division faltered. This pivot marked a move away from the competitive consumer gadget space that the musician initially entered.

DJ Khaled

DJ Khaled was another prominent celebrity who promoted the Centra Tech initial coin offering to his millions of social media followers. He referred to the project as a game changer in the world of digital finance and cryptocurrency. Following the exposure of the company as a fraudulent operation he faced legal repercussions and financial penalties. Like Mayweather he settled with government regulators regarding his failure to disclose compensation for the endorsement. The situation served as a warning to the music industry about the importance of due diligence in tech investments.

Ashton Kutcher

Ashton Kutcher is well known for his successful venture capital career but he also experienced a notable loss with the e commerce site Fab.com. He was an early investor in the platform which once reached a valuation of over one billion dollars. The company suffered from rapid international expansion and high customer acquisition costs that outpaced its revenue growth. Eventually the site was sold for a fraction of its former value after a series of massive layoffs and strategic shifts. This loss highlighted the volatility of the flash sales business model in the online retail sector.

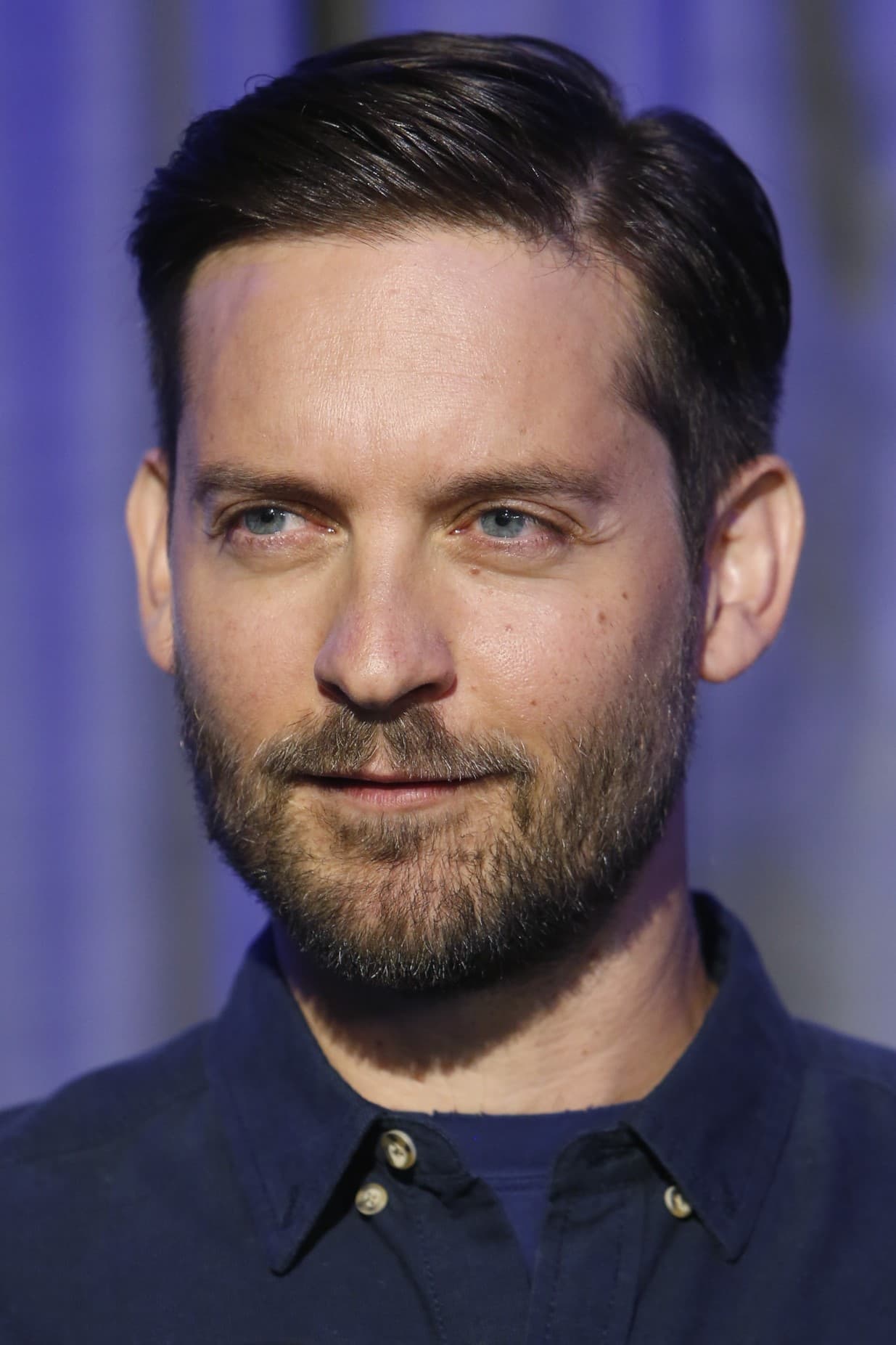

Tobey Maguire

Tobey Maguire joined a group of high profile actors who invested in the social media startup Mobli during its early growth phase. He believed in the platform’s vision of visual storytelling through location based content discovery. The app failed to achieve the necessary scale to survive against the dominance of Facebook and Instagram. His investment was largely wiped out when the company ceased its original operations and restructured its business. This experience reflected the broader trend of Hollywood stars seeking to capitalize on the rise of mobile photography.

Serena Williams

Serena Williams was among the diverse group of celebrity investors who backed the Israeli startup Mobli. She saw the platform as a way to connect with fans through real time video and photo updates. Despite her global influence and the support of other superstars the app could not overcome the network effects of its competitors. The eventual failure of the startup was one of the few setbacks in her otherwise successful career as a venture capitalist. It underscored the extreme difficulty of building a new social network from the ground up.

Lance Armstrong

Lance Armstrong invested in Mobli as part of a strategy to build a diverse portfolio of technology interests. The startup promised a more interactive and community driven approach to photo sharing than existing platforms. Lack of user retention and the rapid evolution of mobile technology led to the decline of the service. His equity in the company lost its value as the firm struggled to find a sustainable revenue model. This investment was part of a larger era where many athletes sought to become tech moguls through early stage funding.

Carlos Santana

Carlos Santana took an unconventional path for a legendary musician by investing in the social media app Mobli. He was attracted to the platform’s ability to create visual channels based on specific interests and events. The company failed to capture the mainstream audience required to compete with larger tech conglomerates. When the startup was sold for its intellectual property his investment did not yield the expected returns. This venture showed that even legendary figures in the arts are susceptible to the high failure rates of tech startups.

Shakira

Shakira was one of the many stars who invested in the short form video app Viddy during its peak popularity. The app was often referred to as the Instagram for video and boasted millions of users in its first year. However the platform saw a dramatic decline in engagement after changes to the Facebook news feed algorithm restricted its growth. The company was eventually sold for a small amount compared to its early hundred million dollar valuation. This investment demonstrated how platform dependency can lead to the sudden downfall of a promising startup.

Jay-Z

Jay-Z participated in a major funding round for Viddy through his investment interests and artistic partnerships. He recognized the potential for short form video content to change how music was consumed and promoted. The app’s failure to maintain its momentum led to a significant loss of value for all its high profile backers. This experience preceded his later venture into the music streaming business with the acquisition of ‘Tidal’. It highlighted the unpredictable nature of social media trends and user behavior.

Katie Couric

Katie Couric joined the ranks of celebrity investors who put money into the video sharing platform Viddy. She saw the potential for the app to be used for journalistic content and personal storytelling in a mobile first format. The rapid rise and subsequent fall of the app left many investors without a return on their capital. Her involvement was part of a broader movement of media personalities trying to stay ahead of digital trends. The failure of Viddy remains a textbook case of a startup that grew too fast without a long term plan.

Bruce Willis

Bruce Willis was one of the original celebrity stockholders and promoters of the themed restaurant chain Planet Hollywood. The company went public with a high valuation but soon faced financial difficulties due to overexpansion and declining interest in themed dining. The chain filed for bankruptcy twice in the late nineties and early two thousands which significantly devalued the initial celebrity investments. Willis and his partners saw their equity stakes diluted or eliminated during the restructuring processes. This venture showed that celebrity branding alone cannot sustain a capital intensive hospitality business.

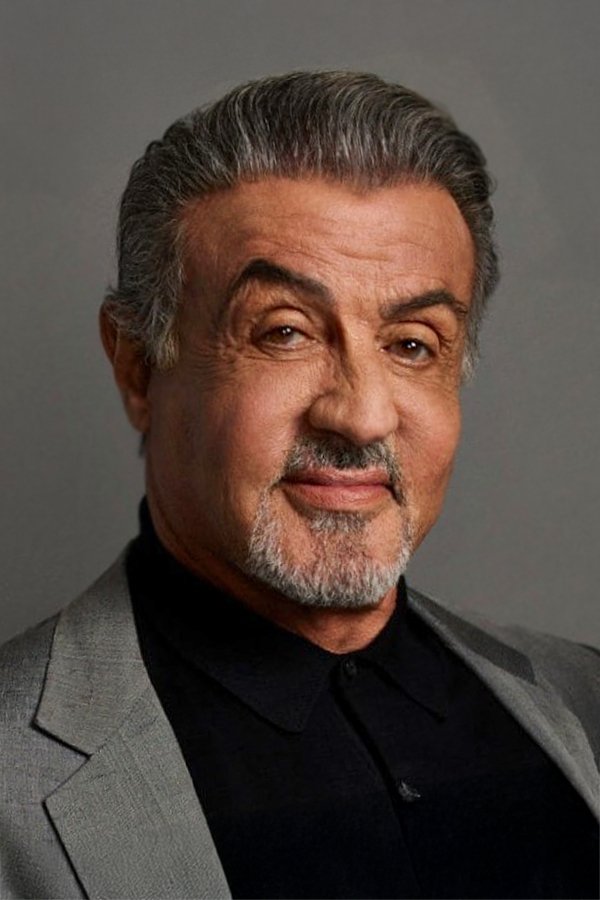

Sylvester Stallone

Sylvester Stallone played a major role in the marketing and global expansion of the Planet Hollywood brand. He appeared at numerous grand openings and used his action movie fame to draw crowds to the restaurants. The company’s inability to manage its debt and keep the concept fresh led to multiple bankruptcy filings. Stallone’s financial interest in the company suffered as the business struggled to compete with more modern dining experiences. The failure of the original business model served as a lesson for future celebrity driven retail ventures.

Demi Moore

Demi Moore was part of the core group of movie stars who helped launch Planet Hollywood into a global phenomenon. She invested her time and capital into the brand which sought to bring the glamour of Hollywood to restaurants around the world. As the company encountered severe financial headwinds her ownership stake lost most of its original value. The eventual collapse of the public company led to a complete overhaul of the brand’s ownership structure. This partnership remains one of the most famous examples of celebrity restaurant investments that failed to endure.

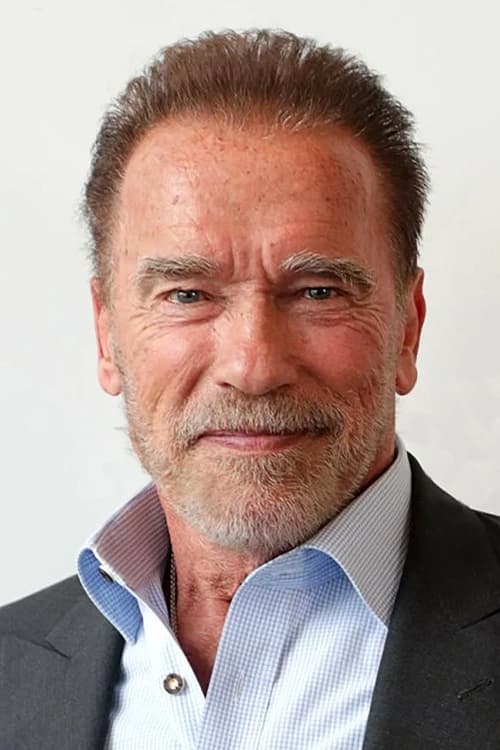

Arnold Schwarzenegger

Arnold Schwarzenegger was a high profile investor and the primary face of the Planet Hollywood chain for many years. He utilized his international stardom to promote the brand in countries across the globe. The company’s stock price plummeted as it struggled with operational inefficiencies and changing consumer tastes. Schwarzenegger eventually severed his ties with the company as it went through bankruptcy proceedings to protect his personal brand. This exit marked the end of an era for the celebrity led dining giant.

Steven Spielberg

Steven Spielberg partnered with DreamWorks co founder Jeffrey Katzenberg to launch a submarine themed restaurant called Dive!. The restaurant featured elaborate nautical decor and a specialized menu designed to create an immersive dining experience. Despite the massive creative talent behind the project the concept failed to attract repeat customers and was difficult to scale. The locations eventually closed their doors after failing to reach profitability in the competitive themed dining market. This failure highlighted that even the greatest storytellers can struggle with the logistics of the food industry.

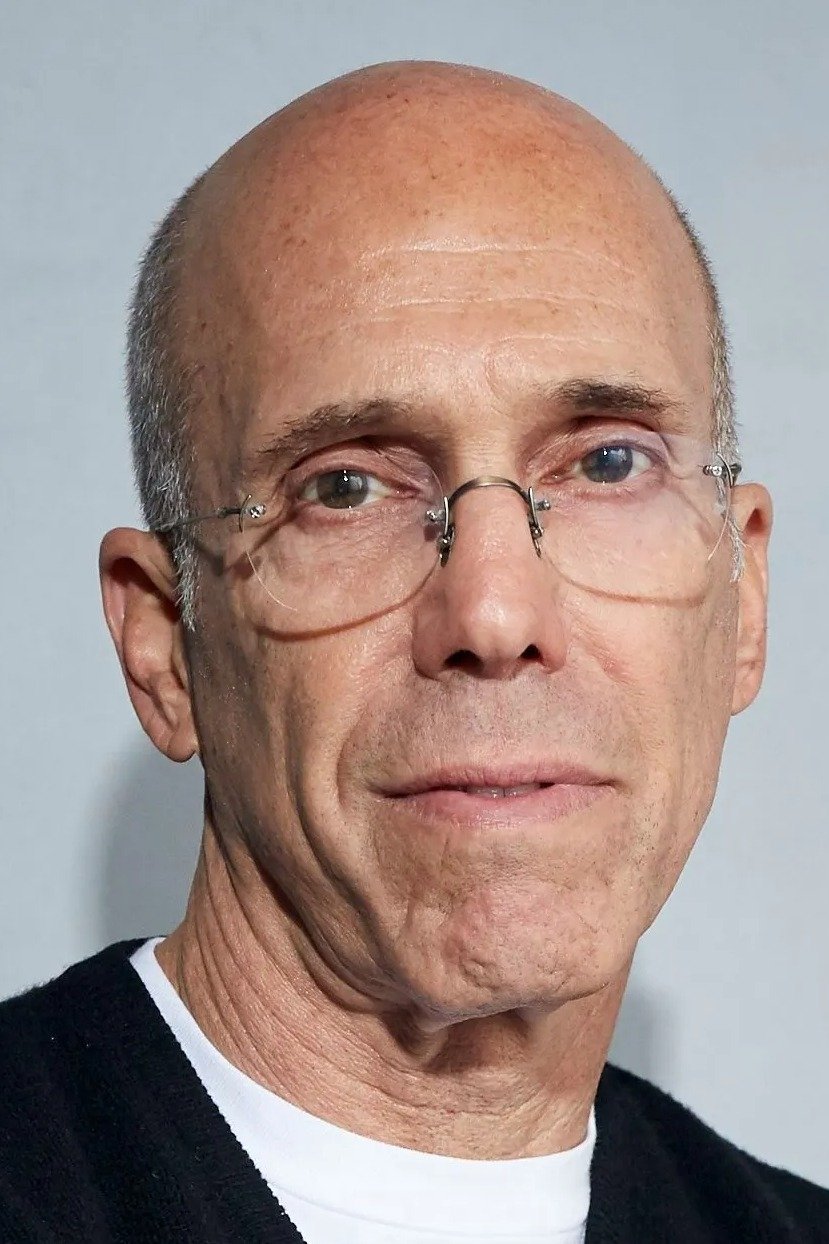

Jeffrey Katzenberg

Jeffrey Katzenberg was the driving force behind the short form streaming service ‘Quibi’ which raised nearly two billion dollars from major investors. He aimed to revolutionize mobile entertainment by offering high quality content designed to be watched in ten minute intervals. The service launched during the global pandemic when people were staying home and preferred long form content on large screens. ‘Quibi’ shut down only six months after its launch marking one of the largest failures in media history. The collapse resulted in massive losses for the Hollywood studios and private equity firms that backed his vision.

Jennifer Lopez

Jennifer Lopez was deeply involved with ‘Quibi’ as both a producer and an equity holder in the platform. She developed original content for the service believing that the mobile first approach was the future of digital media. The rapid demise of the company meant that her creative efforts and financial stakes were largely wasted. Like many other creators she had to find new homes for her projects after the service went dark. This experience showed the risks stars take when they commit to unproven platforms over established streaming services.

Chrissy Teigen

Chrissy Teigen hosted a show on ‘Quibi’ and held a stake in the success of the platform through her production deal. She promoted the service extensively to her large social media following as a new way to consume reality television. The total failure of the service within its first year meant that her show was seen by very few people before the app was deleted. This venture was a rare setback for the star who has otherwise been very successful with her lifestyle and culinary brands. It demonstrated how even strong personal brands cannot save a platform with a flawed business model.

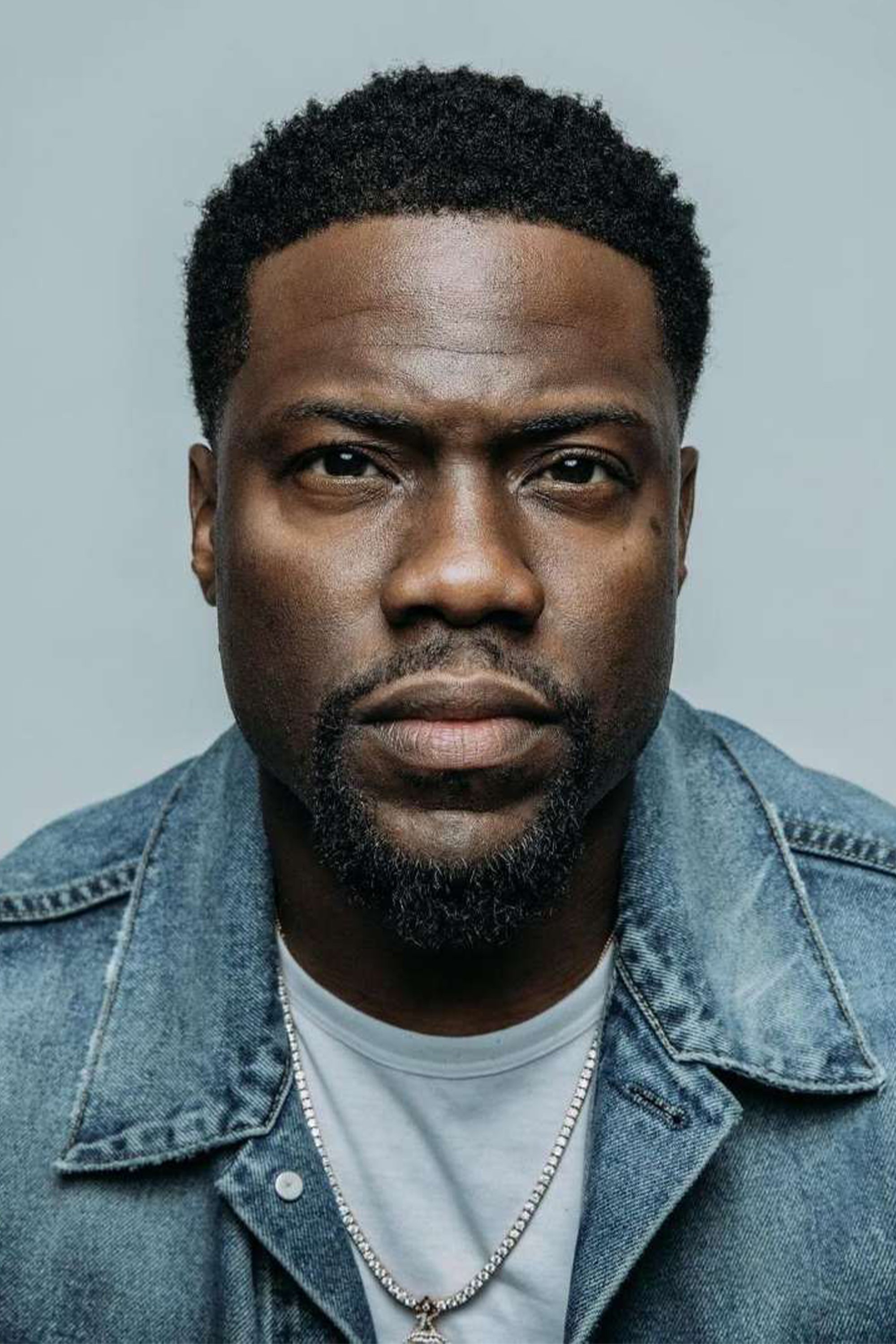

Kevin Hart

Kevin Hart invested significant creative energy and capital into ‘Quibi’ by launching his own studio content on the app. He believed in the concept of quick bites of comedy that could be consumed while on the go. The timing of the launch and the lack of a free ad supported tier contributed to the platform’s inability to grow its subscriber base. Following the shutdown he was forced to negotiate the rights to his content which was eventually sold to another streaming giant. His involvement remains a high profile example of a major star backing a billion dollar tech bust.

Sophie Turner

Sophie Turner starred in one of the flagship scripted series for ‘Quibi’ and had a vested interest in the platform’s growth. The series was designed to showcase high production values in a format tailored for smartphones. Because the service failed to gain traction her work reached a much smaller audience than her previous television projects. The subsequent closure of the company resulted in the loss of future opportunities for the show and her equity in the venture. This highlighted the volatility of the streaming wars for actors seeking new creative outlets.

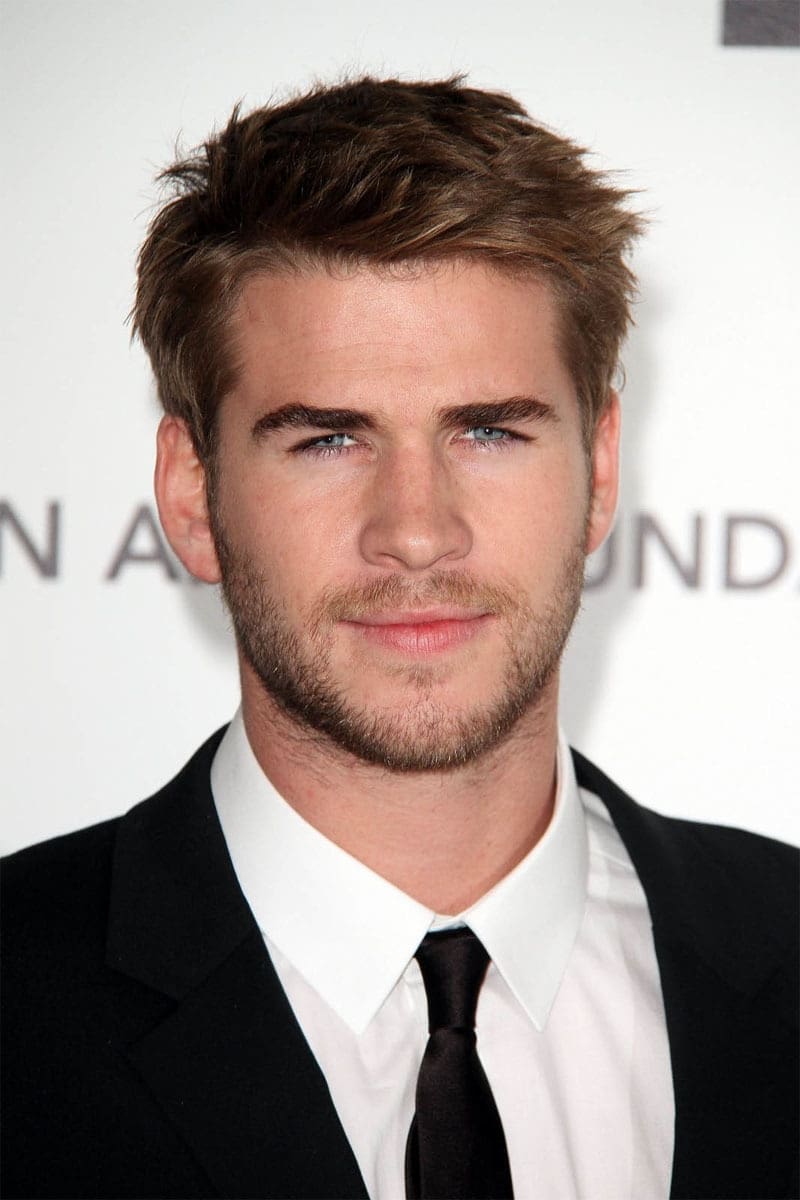

Liam Hemsworth

Liam Hemsworth headlined an action series for ‘Quibi’ that was intended to be one of the platform’s biggest draws. He was part of the early wave of stars who were promised a new way to reach audiences through innovative mobile technology. The platform’s inability to provide a desktop viewing option initially frustrated many potential viewers. When the company collapsed his series was briefly lost in a legal limbo before the library was purchased by a third party. His experience is emblematic of the many talented performers who were caught in the ‘Quibi’ failure.

Anna Kendrick

Anna Kendrick starred in and executive produced a comedy series for ‘Quibi’ that received critical praise but failed to save the platform. She took an active role in promoting the service’s unique technology which allowed viewers to switch between portrait and landscape modes. The technological innovation was not enough to overcome the lack of a compelling reason for users to pay for the service. The sudden shutdown of the company brought an end to her involvement with the experimental format. It served as a reminder that great content still needs a viable distribution platform to succeed.

Eva Longoria

Eva Longoria opened a high end restaurant called Beso in Hollywood which she expanded into a secondary location in Las Vegas. The Las Vegas venture faced significant financial trouble and eventually filed for Chapter 11 bankruptcy protection. She faced multiple lawsuits from partners and creditors as the business struggled to meet its obligations. While the original Hollywood location remained open for a time the failure of the expansion was a costly endeavor for the actress. This case showed the difficulties of managing a luxury hospitality brand across different markets.

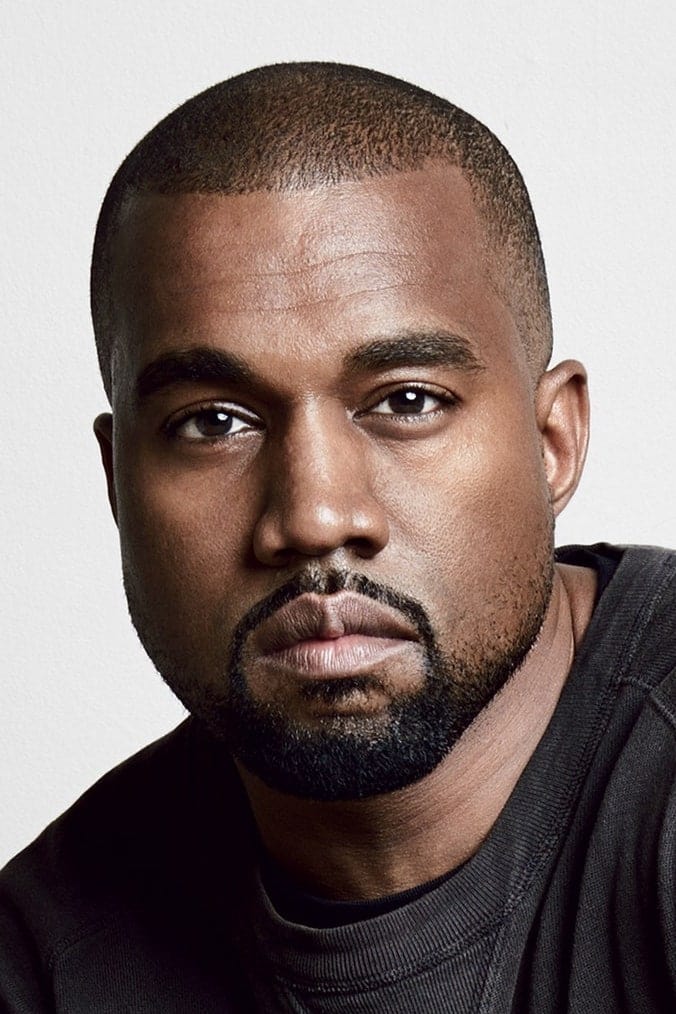

Ye

Kanye West was one of the original artist owners of the music streaming service ‘Tidal’ which was launched to give creators more control. He released his album ‘The Life of Pablo’ exclusively on the platform to drive subscriptions and support the venture. The service struggled with technical issues and faced intense competition from Spotify and Apple Music. West eventually left the ownership group amid disputes over millions of dollars in unpaid bonuses and marketing fees. His tumultuous relationship with the company highlighted the complexities of artist led tech startups.

Madonna

Madonna stood on stage with other superstars to launch ‘Tidal’ as a revolutionary new platform for the music industry. She invested her brand and capital into the service with the hope of changing the economics of streaming for artists. The platform faced immediate backlash for its high subscription price and perceived elitism among its wealthy founders. While the service was eventually sold to a financial technology firm the original vision for artist dominance never fully materialized. Her involvement remains a symbol of the ambitious but flawed attempt to disrupt the streaming market.

Rihanna

Rihanna was a key stakeholder in ‘Tidal’ and utilized the platform to release exclusive music and video content for her fans. She was part of the collective of artists who believed that owning the distribution channel would lead to fairer compensation. The platform struggled to gain a significant share of the global streaming market despite its star studded ownership. The financial returns on the initial investment were hampered by high operational costs and marketing challenges. Her experience with the service demonstrated the difficulty of taking on established tech giants in the media space.

Nicki Minaj

Nicki Minaj joined the ‘Tidal’ ownership group as a way to support fellow artists and explore new revenue streams. She hosted her own radio show on the platform and provided exclusive access to her music videos to drive user growth. The service’s slow adoption rate meant that her content reached fewer people than it would have on larger platforms. Although the company was later sold for a substantial sum the journey was marked by significant controversy and financial uncertainty. This venture showed the challenges of balancing artistic exclusivity with the need for broad market reach.

Usher

Usher was an early investor and vocal supporter of the ‘Tidal’ streaming service during its high profile launch event. He believed that the platform could provide a more high fidelity audio experience for music lovers while supporting the creators. The service faced stiff competition and was frequently criticized for its lack of a free tier for casual listeners. His equity in the company was part of a larger movement of musicians trying to gain leverage in the digital age. The platform’s struggle to compete with tech behemoths served as a reality check for the industry.

Alicia Keys

Alicia Keys was one of the faces of the ‘Tidal’ launch and advocated for the platform’s mission to return value to musicians. She contributed exclusive performances and content to help distinguish the service from its competitors. Despite the collective power of its celebrity owners the service remained a niche player in the streaming industry. The eventual sale of the company to another firm provided an exit for investors but the original goal of the startup had evolved significantly. Her participation highlighted the desire for artists to have a seat at the table in tech boardrooms.

Chris Martin

Chris Martin represented his band Coldplay as one of the founding artist owners of the ‘Tidal’ streaming platform. He participated in the press conference that introduced the service as a turning point for the music business. The platform’s early focus on high priced subscriptions limited its ability to scale quickly enough to challenge the leaders. His financial and creative commitment to the project faced scrutiny as the service struggled to define its place in the market. The experience underscored the difficulty of using celebrity status to shift consumer behavior in tech.

Naomi Osaka

Naomi Osaka signed a long term partnership with FTX that included an equity stake and the creation of custom content for the exchange. She was interested in the platform’s potential to empower women in the world of cryptocurrency and finance. The sudden bankruptcy of the exchange wiped out her investment and led to her name being included in a class action lawsuit. This outcome was a significant blow to her expanding business portfolio outside of professional tennis. It highlighted the risks of athletes endorsing complex financial products that lack regulatory oversight.

Mike Tyson

Mike Tyson partnered with a company called Bitcoin Direct to launch a branded digital wallet and a line of Bitcoin ATMs. The venture aimed to make cryptocurrency more accessible to his global fan base through his recognizable image. The company faced numerous technical issues and failed to gain the necessary regulatory approvals in many jurisdictions. The project eventually faded away without achieving commercial success or widespread adoption. This early foray into the crypto world showed the pitfalls of celebrity branding in a highly technical and regulated industry.

Gwyneth Paltrow

Gwyneth Paltrow was an investor in the peer to peer used car marketplace known as Beepi. The startup aimed to disrupt the traditional car dealership model by handling the inspection and delivery of vehicles directly. Despite raising hundreds of millions of dollars from high profile investors the company suffered from high burn rates and operational inefficiencies. Beepi eventually shut down and sold its remaining parts after failing to secure further funding. This failure served as a reminder that even well funded startups in large markets can collapse under the weight of their own costs.

Justin Timberlake

Justin Timberlake led an investment group that purchased the social media platform Myspace with the intent of revitalizing it as a music hub. He appeared in promotional materials and helped redesign the site to focus on artist discovery and high quality visuals. The relaunch failed to attract users back from Facebook and Twitter which had already become the dominant social networks. The value of the investment plummeted as the site continued to lose traffic and relevance. This project remains a prominent example of how difficult it is to save a declining tech giant.

Nas

Nas is a highly successful tech investor but he was among those who backed the on demand valet parking app Luxe. The service allowed users to summon a valet to park their car in crowded urban areas through a mobile application. The company struggled with the high costs of insurance and labor and eventually shifted its business model several times. Luxe was eventually acquired for its technology by a larger firm after failing to become a standalone success. This investment showed the challenges of on demand service startups that require physical labor and high overhead.

Pharrell Williams

Pharrell Williams was a long time supporter and creative collaborator with the streetwear e commerce site Karmaloop. He attempted to help rescue the company from financial ruin as it faced bankruptcy due to overexpansion and mounting debts. Despite his efforts to bring in new investors and revitalize the brand the company had to go through a formal bankruptcy process. The original founders lost control of the business and the celebrity involvement was not enough to save the firm’s balance sheet. This case illustrated that creative vision cannot always fix fundamental financial mismanagement.

Snoop Dogg

Snoop Dogg was an early investor in the cannabis delivery startup Eaze through his venture capital firm. The company aimed to be the mobile delivery service for cannabis and raised significant capital to expand across states where the product was legal. Eaze faced numerous legal hurdles and challenges with payment processing that hindered its growth and profitability. The company underwent a massive restructuring and saw its valuation drop significantly during various funding rounds. This venture highlighted the unique risks of investing in startups that operate in heavily regulated and legally complex industries.

Share your thoughts on these celebrity business ventures in the comments.