Celebs Involved in Tax Evasion Scandals

The intersection of massive wealth and legal obligation often leads to high profile disputes with government tax authorities. Many celebrities have found themselves in the spotlight for failing to report income or using illegal methods to reduce their tax liability. These cases often result in significant financial penalties and prison sentences that capture public attention. This overview examines numerous public figures who have faced legal consequences for tax evasion or similar financial discrepancies. These stories serve as cautionary tales about the importance of financial transparency and the reach of international law.

Wesley Snipes

The famous actor was convicted of three misdemeanor counts of failing to file federal income tax returns. He served three years in a federal prison after his appeals were exhausted. Prosecutors noted that he had avoided paying millions of dollars in taxes during a period of significant career success. His legal team argued that he had received poor advice from financial consultants who claimed the tax laws were invalid. Since his release the star has worked to rebuild his career and settle his remaining debts with the government.

Lauryn Hill

The singer and songwriter pleaded guilty to charges of tax evasion after failing to pay taxes on over one million dollars of income. She faced a three month prison sentence followed by a period of home confinement and probation. During her court case she explained that she had withdrawn from society and the music industry to protect her family. The artist eventually paid back the significant amount of taxes and interest owed to the government. Her legal troubles highlighted the financial pressures faced by even the most successful figures in the music industry.

Shakira

The global music icon faced a high profile legal battle in Spain regarding her tax residency status over several years. Prosecutors alleged that she lived in the country for more than half of the year and therefore owed substantial tax revenue. To avoid a lengthy trial and the possibility of prison time she reached a settlement agreement with the authorities. She paid a fine of several million dollars in addition to the back taxes that were previously in dispute. The singer maintained that she followed the advice of her financial experts throughout the period in question.

Fan Bingbing

One of the most famous actresses in China disappeared from public view for several months during a major investigation into her finances. Authorities discovered that she had used secret contracts to hide her true earnings from film productions. She was eventually ordered to pay nearly one hundred thirty million dollars in back taxes and fines to avoid criminal prosecution. The scandal led to a significant crackdown on the entertainment industry and changed how celebrity salaries are reported in her home country. She has since made a gradual return to the public eye and professional acting.

Lionel Messi

The legendary soccer player and his father were found guilty of tax fraud in a Spanish court. The case involved the use of offshore accounts to hide income from image rights and avoid paying taxes on the earnings. He was sentenced to twenty one months in prison but the sentence was later converted to a large fine because he had no prior record. The athlete argued that he was focused on playing sports and trusted his father and advisors to handle his financial affairs. Despite the legal conviction his career continued to flourish as he moved to new clubs around the world.

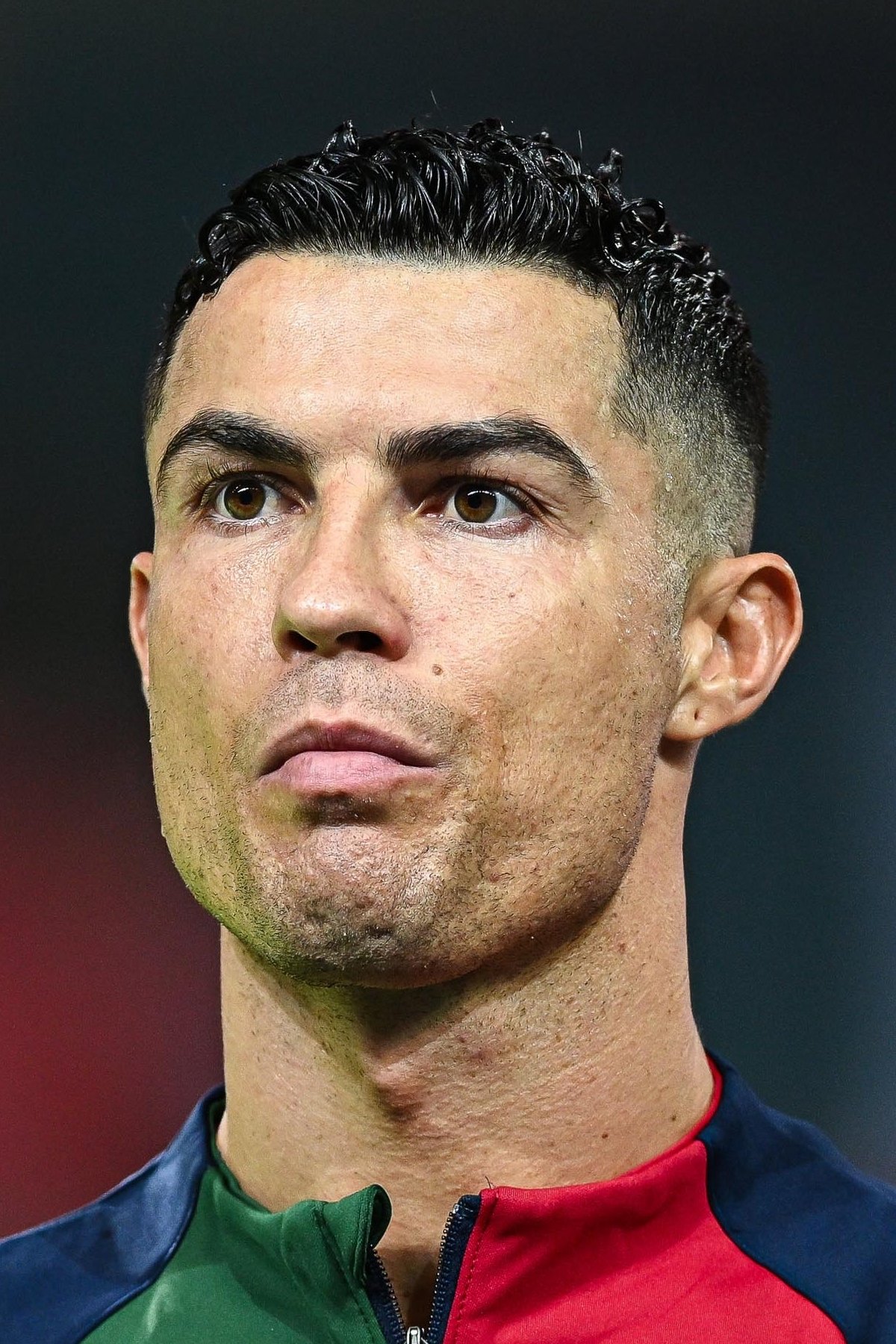

Cristiano Ronaldo

Another world famous athlete faced significant legal scrutiny for allegedly hiding income from image rights in offshore accounts. He reached a settlement with Spanish tax authorities to pay a fine of nearly twenty million dollars to resolve the case. The settlement also included a suspended prison sentence that did not require him to serve time behind bars. He maintained that he never intended to evade taxes but accepted the agreement to put the legal matter behind him. This case highlighted the ongoing efforts by various governments to regulate the earnings of international sports stars.

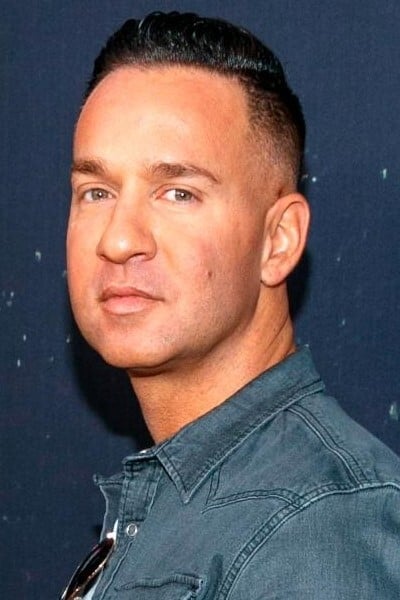

Mike Sorrentino

The reality television star known for ‘Jersey Shore’ was indicted on charges of tax evasion and conspiracy. He and his brother were accused of failing to properly report millions of dollars in income earned from their various business ventures. He pleaded guilty to the charges and served an eight month sentence in federal prison. After his release he became a vocal advocate for sobriety and responsible financial management. His journey through the legal system was documented in later seasons of his popular television program.

Teresa Giudice

The star of ‘The Real Housewives of New Jersey’ faced a high profile legal crisis when she and her husband were charged with multiple counts of fraud and tax evasion. She pleaded guilty to several charges and served nearly one year in a federal correctional institution. The couple was accused of hiding income and making false statements on loan applications and bankruptcy filings. Following her release she published a memoir about her time in prison and returned to her reality television career. The legal saga had a profound impact on her family life and public image.

Joe Giudice

As the husband of a reality star he faced similar legal challenges and was convicted of several financial crimes including tax evasion. He served a prison sentence of forty one months before being transferred to the custody of immigration officials. Because he was not a United States citizen his conviction led to his eventual deportation to Italy. He spent years fighting the legal system to return to his family but ultimately settled in his home country. His case serves as a stark reminder of the non financial consequences that can follow tax related convictions.

Nicolas Cage

The prolific actor faced a massive tax bill after the government alleged that he failed to pay millions of dollars in taxes over several years. He claimed that his financial manager had led him into a path of financial ruin and significant debt. To resolve his obligations he sold many of his personal assets including multiple homes and a rare comic book collection. He has since worked consistently in various film roles to pay off his debts and stabilize his finances. The star has been open about his financial struggles and his dedication to fulfilling his legal obligations.

Willie Nelson

The country music legend faced one of the most famous tax scandals in history when the government seized his assets to cover a massive debt. He owed over sixteen million dollars in back taxes and penalties due to poor financial management by his advisors. In a unique move he released an album titled ‘The IRS Tapes’ to help raise funds for his legal settlement. Fans supported the singer during this time and his assets were eventually returned to him after he reached an agreement. He remains a beloved figure in music and has maintained a successful career for decades since the incident.

Stephen Baldwin

The actor faced legal consequences after failing to pay state income taxes for three consecutive years. He pleaded guilty to the charges and was ordered to pay back hundreds of thousands of dollars in taxes and penalties. He avoided prison time by reaching a settlement and agreeing to a period of probation. The star cited poor legal and financial advice as the reason for his failure to meet his tax obligations. He eventually satisfied the court requirements and has continued to work in the entertainment industry.

Ja Rule

The rapper and actor served time in prison for both weapons charges and failing to pay federal taxes. He admitted to failing to pay taxes on several million dollars of income earned during the height of his music career. He served a two year sentence and paid over one million dollars in restitution to the government. Since his release he has focused on various business projects and his return to performing. He has spoken publicly about the importance of staying on top of financial responsibilities and hiring trustworthy advisors.

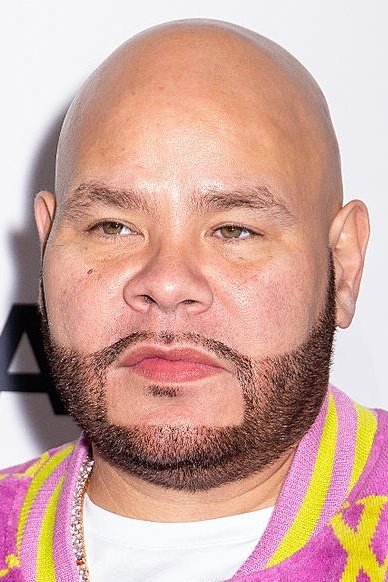

Fat Joe

The prominent hip hop artist pleaded guilty to failing to file federal income tax returns for two years. He was sentenced to four months in prison and ordered to pay a significant fine along with his back taxes. During the proceedings he took full responsibility for the oversight and apologized for his actions. He served his time and quickly returned to his career in music and entertainment. The rapper has since become an advocate for financial literacy within the music community.

Domenico Dolce

One half of the famous fashion duo faced a lengthy legal battle in Italy over allegations of tax evasion. He and his partner were accused of using a holding company in Luxembourg to avoid paying taxes on their massive earnings. A court initially found them guilty and sentenced them to prison but the conviction was later overturned on appeal. The highest court in Italy eventually cleared them of the charges and ruled that their financial structure was legal. This case was closely watched by the global fashion industry and highlighted complex international tax laws.

Stefano Gabbana

As a cofounder of a major luxury brand he was also embroiled in the same tax evasion investigation as his business partner. He faced the same initial conviction and subsequent legal battles to clear his name in the Italian courts. He maintained his innocence throughout the process and argued that the company always operated within the law. The final acquittal was a significant victory for the designers and their brand. Their case demonstrated the challenges that global corporations face when dealing with tax authorities across multiple jurisdictions.

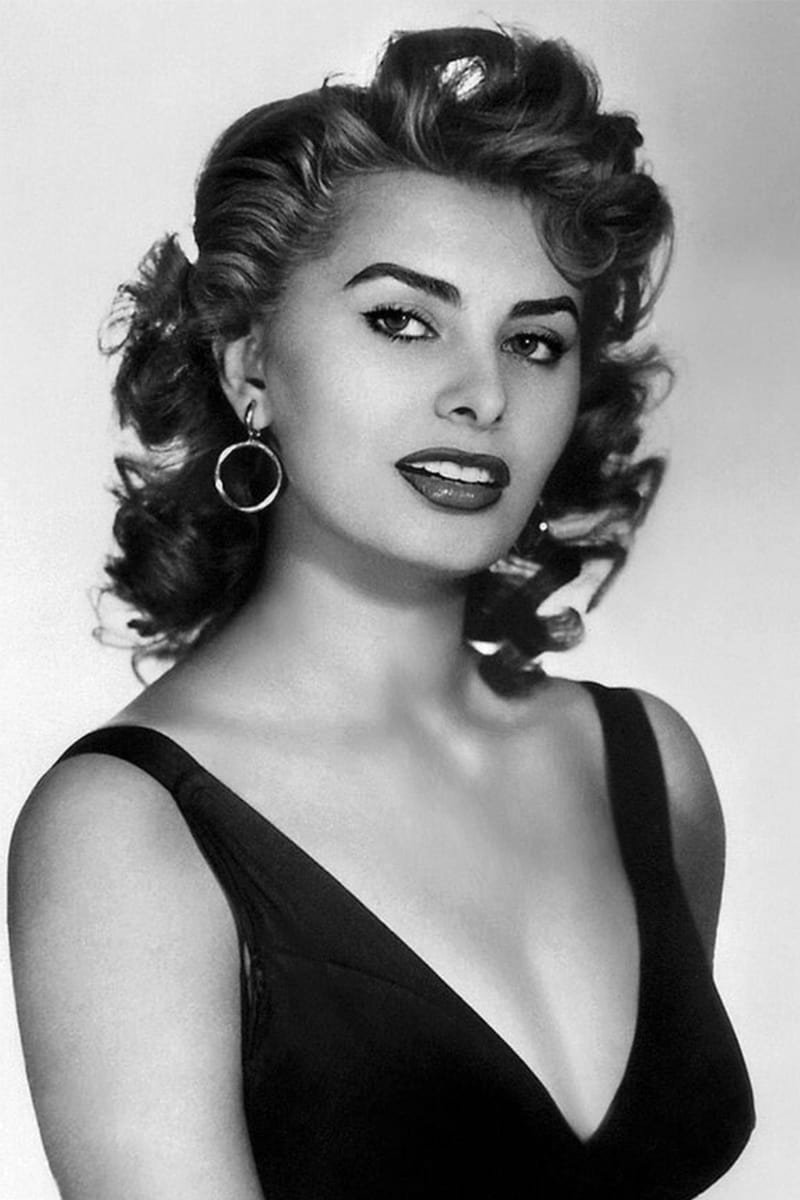

Sophia Loren

The legendary Italian actress spent seventeen days in prison due to a long standing dispute over her tax returns from the nineteen seventies. She was accused of underreporting her income and failing to pay the appropriate amount to the Italian government. Decades after her time in prison the highest court in Italy finally ruled that she had actually been correct in her tax calculations. The actress felt vindicated by the ruling but had already endured the public scandal and time behind bars. Her experience is often cited as a famous example of a celebrity facing harsh penalties for contested tax issues.

Chuck Berry

The pioneer of rock and roll music faced several legal issues throughout his life including a conviction for tax evasion. He was sentenced to four months in prison and ordered to perform community service after failing to properly report his income. Prosecutors alleged that he preferred to be paid in cash and did not accurately document his earnings from concerts. Despite these legal setbacks he continued to perform and influence generations of musicians. He is remembered as one of the most important figures in the history of popular music.

Al Capone

The notorious gangster was famously brought down not for his violent crimes but for failing to pay his income taxes. Federal investigators spent years building a case against him after failing to secure convictions for other illegal activities. He was eventually sentenced to eleven years in federal prison and ordered to pay heavy fines and back taxes. He served much of his sentence at Alcatraz before being released due to declining health. This case set a significant precedent for using tax laws to prosecute high profile individuals suspected of other crimes.

Richard Hatch

The winner of the first season of ‘Survivor’ faced a major legal scandal when he failed to pay taxes on his million dollar prize. He was convicted of tax evasion and served over three years in federal prison. He argued that the production company should have been responsible for the taxes or that he had witnessed illegal activities during filming. The court did not accept his defenses and he was even returned to prison later for failing to comply with the terms of his supervised release. His case remains the most famous example of a reality television contestant facing serious legal consequences for their winnings.

Boris Becker

The former tennis champion was convicted of hiding assets and loans to avoid paying his debts following a bankruptcy filing. A court in London found him guilty of several charges under the Insolvency Act and sentenced him to two and a half years in prison. He served a portion of his sentence before being deported to his home country of Germany. The athlete had previously faced tax evasion charges in Germany related to his residency status. His financial and legal struggles have been a major topic of public discussion throughout his post career life.

Pamela Anderson

The actress and model faced several tax liens from the government for unpaid income taxes over multiple years. She reportedly owed hundreds of thousands of dollars to both federal and state authorities during different periods of her career. She worked with financial advisors to resolve the debts and eventually paid off the balances owed. The star has spoken about the complications of managing wealth and the importance of hiring the right people to handle finances. Despite these hurdles she has maintained a long and successful career in television and film.

Lil Kim

The hip hop icon faced a significant tax lien for unpaid federal taxes spanning nearly a decade of her career. The government alleged that she owed over one million dollars in back taxes and penalties. She also faced other legal and financial challenges including a prison sentence for a separate matter involving perjury. The artist worked over several years to settle her obligations and restore her financial standing. She continues to be a highly influential figure in the music industry and has released new projects for her fans.

Method Man

The rapper and member of the Wu Tang Clan was arrested for failing to file personal income tax returns for several years. He reportedly owed the state of New York a significant amount of money in back taxes and interest. He pleaded guilty to the charges and paid the full amount owed to avoid a prison sentence. The artist claimed that he was simply disorganized and had neglected his financial responsibilities. He has since been proactive about his taxes and continues to enjoy a successful career in both music and acting.

Marc Anthony

The popular singer and actor faced multiple tax liens for unpaid taxes on his properties and personal income. He reportedly owed several million dollars to the government over different periods of his career. He worked quickly to resolve the issues and paid off the outstanding balances to avoid further legal action. The star blamed his financial management team for the oversights and took steps to reorganize his business affairs. He remains one of the top selling Latin artists in the world with a massive global following.

Lindsay Lohan

The actress faced several years of financial instability and legal issues including multiple tax liens. The government seized her bank accounts at one point to recover unpaid federal income taxes. She received assistance from fellow actors and worked through her professional commitments to pay off her debts. Her financial struggles were often linked to her personal challenges and frequent appearances in the media. In recent years she has made a career comeback and has worked to stabilize her personal and financial life.

Judy Garland

The legendary star of ‘The Wizard of Oz’ struggled with significant financial problems and tax debts throughout the later years of her life. The government placed liens on her earnings and seized her home to cover unpaid taxes. Her financial difficulties were often the result of poor management by agents and personal struggles with health. Despite her status as a Hollywood icon she spent much of her career working to pay off her mounting debts. Her story is frequently used to illustrate the lack of financial protection for stars during the classic studio era.

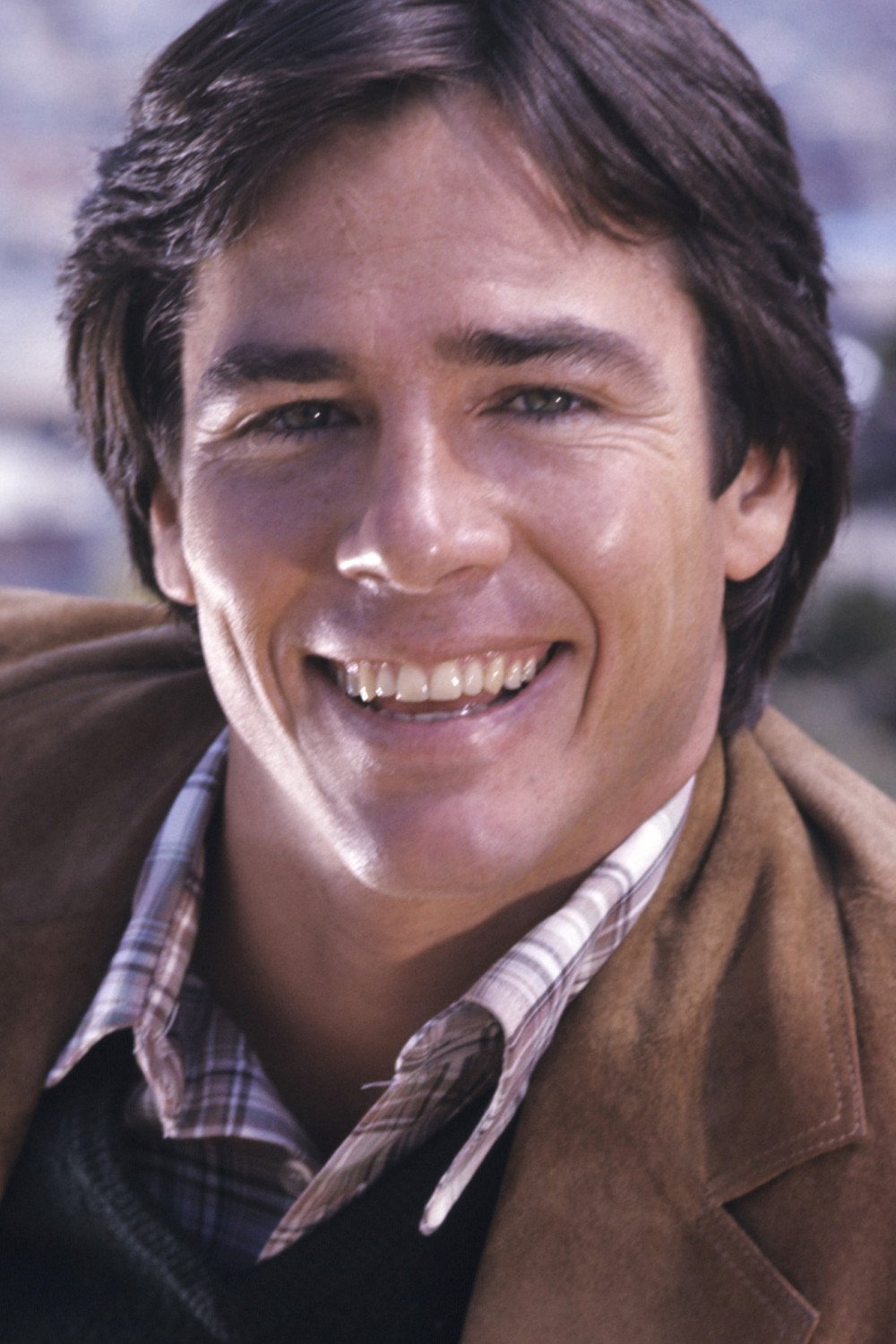

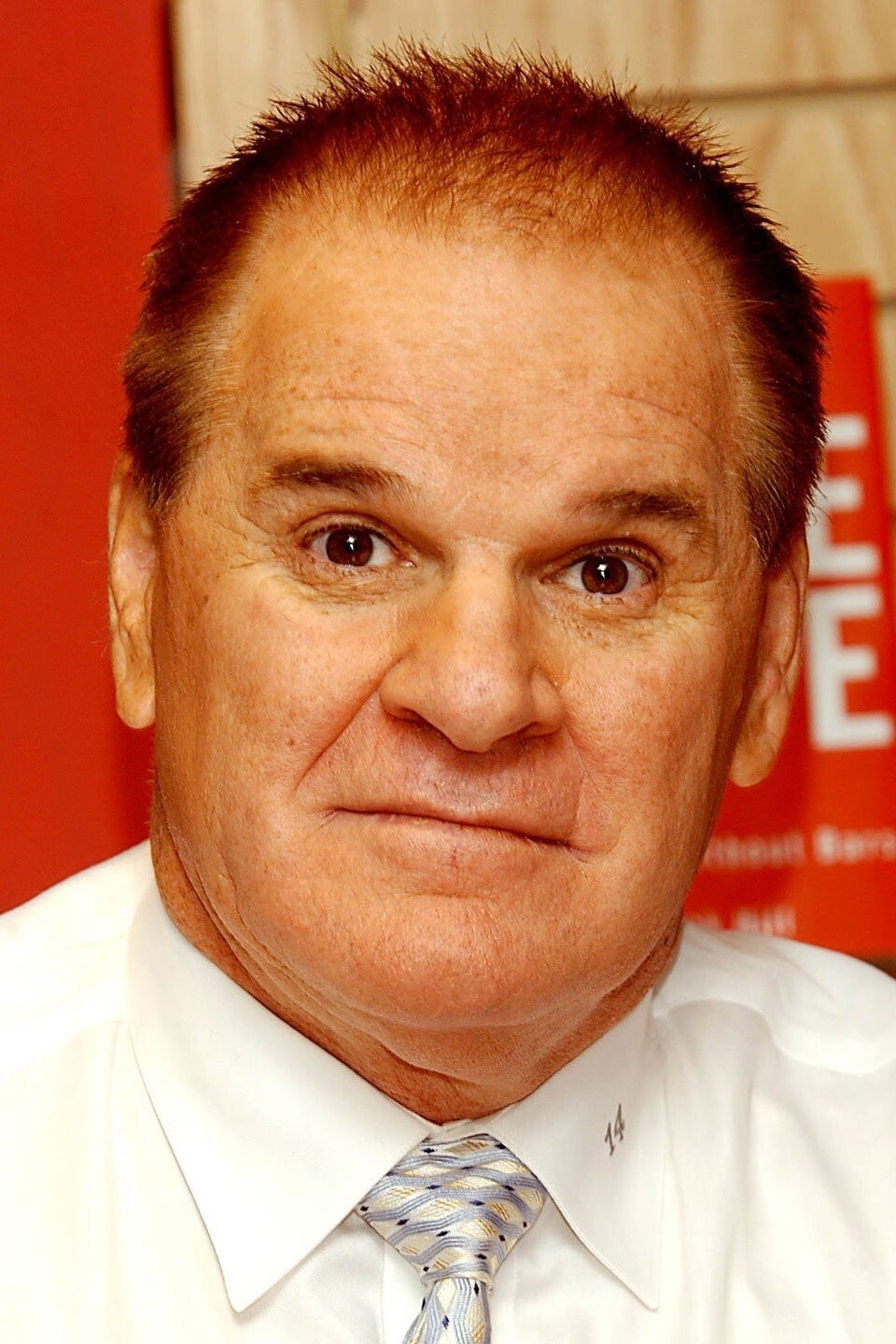

Pete Rose

The baseball legend served time in prison for filing false federal income tax returns. He failed to report income earned from selling autographs and memorabilia as well as winnings from gambling on horse races. He was sentenced to five months in prison and was required to pay all back taxes and interest. This legal conviction occurred during the same period he was facing a lifetime ban from baseball for gambling. He has spent decades attempting to restore his reputation and gain entry into the Baseball Hall of Fame.

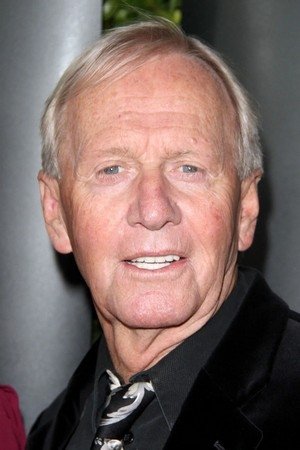

Paul Hogan

The star of ‘Crocodile Dundee’ was involved in a long running dispute with Australian tax authorities regarding his residency and income. He was even barred from leaving the country at one point until he reached an agreement to pay a portion of the contested taxes. He maintained that he was a resident of the United States for tax purposes and did not owe money to Australia. The legal battle lasted for several years before it was eventually settled through a confidential agreement. He has continued to be a popular figure in both his home country and internationally.

Jimmy Carr

The British comedian faced intense public criticism after it was revealed that he used a legal but aggressive tax avoidance scheme. The Prime Minister at the time even commented on the situation and described the behavior as morally wrong. While the scheme was not illegal the star chose to apologize and withdraw from the arrangement following the public backlash. He has since joked about the incident in his comedy specials and has maintained his career as a top television host. This situation sparked a national debate in the United Kingdom about the ethics of tax planning for the wealthy.

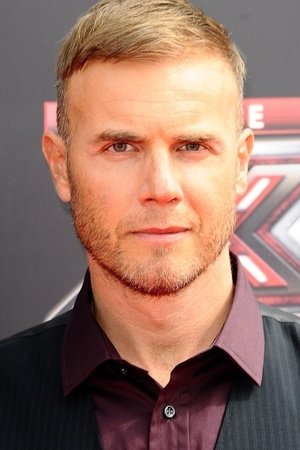

Gary Barlow

The singer and member of the band Take That was involved in a significant tax controversy involving a music industry investment scheme. A court ruled that the scheme was designed specifically for tax avoidance and ordered the participants to pay back millions of pounds. He faced calls to return his honorary titles but he chose to settle his debts and remain in the public eye. He issued a public apology for the mistake and stated that he had not intended to do anything wrong. The artist has since focused on his music career and various charitable endeavors.

Chris Tucker

The star of the ‘Rush Hour’ film franchise faced a massive tax lien for unpaid federal income taxes totaling several million dollars. He reportedly struggled to keep up with his tax obligations following the huge success of his early career. He reached a settlement with the government to pay back the debt over time and worked to resolve his financial issues. The actor has been selective about his film roles but remains a highly respected figure in the comedy world. His financial journey has been a topic of interest for fans following his long breaks from the screen.

Dionne Warwick

The legendary singer filed for bankruptcy after years of financial struggle and significant tax debts. She reportedly owed millions of dollars to both federal and state tax authorities due to poor management of her business affairs. The bankruptcy filing allowed her to reorganize her finances and address the long standing liens on her income. She has continued to perform and record music while working to maintain her financial independence. Her career spans several decades and she is recognized as one of the most successful female vocalists of all time.

Mary J. Blige

The iconic singer faced multiple tax liens for unpaid federal and state taxes over several years. She was accused of owing millions of dollars to the government while dealing with a highly publicized divorce. She worked with her legal and financial teams to settle the debts and has spoken about the importance of being aware of one’s finances. Despite these challenges she has continued to release successful albums and earn critical acclaim for her acting roles. She remains a powerful force in the music industry and an inspiration to many.

Sinbad

The comedian and actor filed for bankruptcy twice due to overwhelming tax debts and other financial liabilities. He reportedly owed the government several million dollars in unpaid income taxes dating back many years. He explained that his financial troubles were the result of business investments that did not succeed and high personal expenses. He has worked consistently to pay off his obligations and has remained active in the entertainment industry. His resilience in the face of financial adversity has been noted by his peers and fans.

Toni Braxton

The award winning singer has famously filed for bankruptcy on two separate occasions due to financial mismanagement and tax issues. She faced significant debts to the government and other creditors despite her massive success in the music industry. Her health struggles also played a role in her financial challenges as they impacted her ability to perform and earn income. She eventually settled her tax obligations and has continued to build a successful career in music and television. She is often cited as an example of the financial volatility that can exist in the music business.

Burt Reynolds

The late movie star faced significant financial difficulties including a bankruptcy filing and unpaid tax debts later in his life. He reportedly owed large sums to the government and faced the possibility of losing his estate. He worked to resolve these issues by selling personal items and continuing to take acting roles in various productions. Despite these challenges he remained a beloved figure in Hollywood and is remembered for his legendary career. He spoke openly about his financial ups and downs in his autobiography.

MC Hammer

The rapper became a symbol of celebrity financial struggle after filing for bankruptcy with millions of dollars in debt. Much of his debt was owed to the government in the form of unpaid income taxes from the peak of his fame. He had spent his fortune on a massive estate and a large staff of employees before his earnings declined. He eventually paid off his tax debts and transitioned into a career as a businessman and tech investor. He has since become a public speaker on the importance of financial wisdom and planning.

Todd Chrisley

The star of the reality show ‘Chrisley Knows Best’ was convicted of multiple financial crimes including tax evasion and bank fraud. He and his wife were accused of conspiring to defraud banks and hiding income from the government to avoid paying taxes. He was sentenced to twelve years in a federal prison and ordered to pay restitution. Throughout the trial he maintained his innocence and claimed that a former employee was responsible for the illegal activities. His legal battle has been a central focus of news reports surrounding his family and their television career.

Julie Chrisley

As the wife of Todd Chrisley she was also convicted on several counts related to the couple’s financial crimes. She was found guilty of tax evasion and bank fraud and received a seven year prison sentence. Prosecutors argued that she played an active role in the schemes to obtain millions of dollars in fraudulent loans. Following her conviction she began serving her sentence in a federal facility while her legal team continued to file appeals. The case has led to the cancellation of their long running reality television programs.

Hunter Biden

The son of the United States President faced federal charges related to failing to pay his taxes on time and filing false returns. He pleaded guilty to several counts of tax evasion and other financial crimes in a high profile legal proceeding. Prosecutors alleged that he lived a lavish lifestyle while failing to meet his tax obligations over several years. He has since paid the back taxes and penalties with the help of a benefactor while continuing to navigate his legal challenges. The case has been a major point of political and public discussion.

Martha Stewart

The lifestyle mogul served time in federal prison for crimes related to an insider trading investigation but also faced related tax scrutiny. She was convicted of conspiracy and obstruction of justice and making false statements to federal investigators. Following her release she had to pay significant fines and was briefly barred from serving as an officer in her company. She worked hard to rebuild her brand and became even more successful in the years following her incarceration. Her ability to bounce back from a major legal scandal is considered one of the greatest career rehabilitations in media history.

Terrence Howard

The actor known for his role on ‘Empire’ has been under investigation for several years regarding potential tax evasion. The government has looked into his financial records and those of his former wife to determine if income was properly reported. He has faced tax liens in the past and has worked to resolve various financial disputes with authorities. The star has expressed frustration with the legal system and the ongoing nature of the inquiries. He remains a prominent actor and has continued to work on major television and film projects.

Courtney Love

The musician and actress has faced multiple tax liens and financial lawsuits throughout her career. She has reportedly owed hundreds of thousands of dollars in unpaid taxes to both federal and state governments. Her financial situation has often been complicated by legal battles over the estate of her late husband and her own business dealings. She has worked to settle her debts and maintain her creative career in music and art. Despite the controversies she remains a significant figure in the history of alternative rock.

Ozzy Osbourne

The legendary rock star and his wife were hit with a massive tax lien for unpaid federal taxes over several years. The government alleged that the couple owed over one million dollars in back taxes and interest. They quickly worked to pay off the debt and blamed their financial managers for the error. The couple has been open about their past mistakes and the importance of hiring trustworthy professionals to handle their wealth. Their reality show and music careers have allowed them to remain among the most famous families in entertainment.

Sharon Osbourne

As a television personality and manager she was equally involved in the tax scandal that affected her family. She took public responsibility for the oversight and explained that she had neglected to properly monitor their tax filings. The couple paid the full amount owed shortly after the lien was made public to avoid further legal trouble. She has since continued her successful career as a talk show host and judge on various talent competitions. Her direct approach to the situation helped the family move past the scandal quickly.

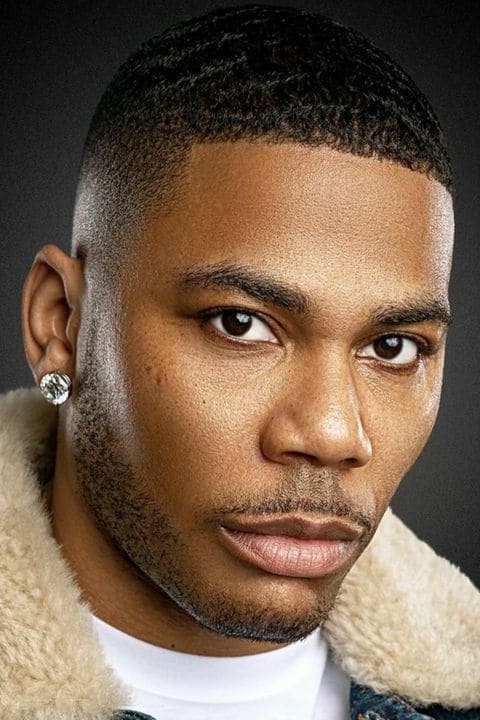

Nelly

The Grammy winning rapper faced a significant tax lien from the government for unpaid federal taxes totaling several million dollars. When the news of his debt broke his fans started a social media campaign to stream his music and help him earn the money to pay it off. He worked with his financial advisors to address the situation and resolve his obligations to the tax authorities. The artist has continued to tour and release new music while expanding his business interests. He remains one of the most successful rappers from the early two thousand era.

Heidi Fleiss

The woman known as the Hollywood Madam was convicted of tax evasion and money laundering related to her high end escort business. She served twenty one months in federal prison after being found guilty of failing to report her significant illegal income. Her trial was a major media event that involved testimony about several high profile clients in the entertainment industry. Since her release she has lived a quieter life and has been involved in various animal rescue efforts. Her case is often cited as a classic example of using tax laws to prosecute individuals involved in other controversial activities.

Share your thoughts on these celebrity tax scandals in the comments.