20 Video Game Economies That Crashed In Real Time

Video game worlds often feel stable until a single exploit or design tweak sends prices spinning and players scrambling to protect their wealth. When that happens you can watch markets unravel minute by minute as trading freezes, currencies inflate, and studios rush out emergency fixes. These sudden collapses usually start with duplication bugs, unchecked botting, or policy changes that ripple through every marketplace. Here are notable moments when in game economies buckled in front of everyone and the fallout became part of gaming history.

‘EVE Online’ (2003)

A player run bank called EBank imploded after revelations of missing funds, which sparked a liquidity panic across major trade hubs. Industrial cartels later triggered price shocks by choking supply of critical minerals, and a crackdown on third party gambling abruptly removed vast amounts of currency from circulation. Developers imposed resource scarcity then reversed course, each shift causing real time swings in ship and module prices. Market historians still cite these events as textbook cases of supply and demand whiplash inside a sandbox economy.

‘Diablo III’ (2012)

The real money auction house linked loot drops directly to cash and the economy lurched as botting and flipping flooded the market. Prices for staple gear crashed when drop rates were adjusted and gold selling outpaced gold sinks. Emergency patches arrived and trading rules changed repeatedly, which forced value resets overnight. The auction house was eventually closed and the economy stabilized around bind on account systems.

‘World of Warcraft’ (2004)

Duplication exploits and bot farms periodically injected huge amounts of gold, causing auction house inflation that players felt within hours. A notorious incident saw a corrupted data issue wreck undercutting logic and commodity prices collapsed until hotfixes landed. Later, mission based gold printing overwhelmed sinks and markets for materials whipsawed as rewards were nerfed. Each fix produced immediate price corrections as traders repriced everything from flasks to mounts.

‘RuneScape’ (2001)

Early party hat trading saw speculative bubbles that burst when supply realities caught up, wiping fortunes in a single session. Introduction and removal of trading limits created rapid shifts in merchant tactics and black market swapping. High profile duplication bugs forced emergency rollbacks while prices for rare items cratered in the confusion. The grand exchange became a live feed of panic listings whenever an exploit emerged.

‘Guild Wars 2’ (2012)

A crafting recipe error let players mass produce endgame components for a fraction of their worth, and the market plunged immediately. Precious materials flooded the trading post and prices bottomed out before the developer disabled systems and banned accounts. Currency exchange rates between gems and gold swung wildly as players rushed to hedge. After fixes, the economy needed time to absorb the surplus and regain normal pricing.

‘The Elder Scrolls Online’ (2014)

A launch era duplication bug poured high value materials into guild stores and inflation took off within hours. Traders moved fast to convert windfalls into housing and mounts, which spread the impact beyond crafters. The studio temporarily shut down trading features and rolled out corrective patches to stem the bleed. Prices only normalized after large scale bans and item deletions drained the excess.

‘New World’ (2021)

Multiple gold duplication exploits appeared soon after release and each one forced the studio to disable wealth transfers and trading posts. Company treasuries and territory tax systems magnified the shock as owners lost income streams. Crafted item values swung sharply when refunds and compensations hit player wallets. The economy endured repeated freezes that traders could watch unfold in real time chat.

‘Path of Exile’ (2013)

League specific crafting interactions occasionally created unintended duplication that shattered market balance mid season. Mirror tier items appeared in unexpected quantities and staple currencies slid in value as supply outpaced sinks. Developers pushed hotfixes and disabled recipes, which triggered immediate repricing across trade indexes. Entire build metas were affected because unique item costs no longer reflected rarity.

‘Team Fortress 2’ (2007)

A crate bug briefly turned ordinary containers into near guaranteed high tier drops and the hat market collapsed during the rush. Traders liquidated inventories as unusual effects lost scarcity and long held price charts became useless. The issue was corrected and many items were flagged but the shock reset expectations about rarity. For days afterward, community tools showed rapid swings as confidence returned.

‘Counter-Strike: Global Offensive’ (2012)

Policy changes to trading and gambling created sudden liquidity squeezes that pushed skin prices down within minutes. When third party wagering was curtailed, demand for specific skins vanished and market listings piled up. Later, changes to trade cooldowns reduced flipping velocity and compressed spreads across popular knives and rifles. The market adapted, but the initial drops were felt live by anyone watching listing queues.

‘Escape from Tarkov’ (2016)

Adjustments to vendor inventories and loot tables could erase profitable routes overnight, crashing prices on key barter items. A notable swing occurred when bitcoin related items and rare electronics were rebalanced and returns fell quickly. Players hoarded then dumped goods as patch notes arrived, which created sharp peaks and valleys in flea market charts. The wipe cycle amplified every move because fresh starts reset baselines and magnified panic.

‘Lost Ark’ (2019)

Large bot waves injected gold at scale and the auction house flooded with underpriced materials. The studio responded with mass bans and temporary restrictions, which yanked liquidity and shocked prices the other way. Honing costs and reward tweaks produced immediate shifts in demand for shards and stones. The market yo yoed in real time as each mitigation pass landed.

‘MapleStory’ (2003)

Meso duplication incidents periodically crushed the value of the currency and forced emergency maintenance. Rare scrolls and equipment tumbled as illicit stock overwhelmed legitimate supply. After fixes, new meso sinks were introduced to soak up the excess and stabilize pricing. Traders tracked these events because fortunes were made or lost within a single evening.

‘Ultima Online’ (1997)

Early duplication and housing bugs sent rare resources into the economy and prices collapsed on player vendors. The open trading model meant word of exploits spread fast and markets adjusted within minutes. The developer purged items and issued patches, but the shock lingered as players refused to pay old premiums. This cycle defined some of the first real time economic crashes in a persistent world.

‘Star Wars Galaxies’ (2003)

Credit duplication and vendor issues caused massive inflation that devalued legitimate crafting. Resource spawns with extreme stats further distorted pricing as min max crafters cornered niches. Emergency interventions altered drop tables and credits were removed, which jolted the market again. The player economy never fully regained its pre exploit balance.

‘Second Life’ (2003)

A high profile bank collapse erased user deposits and sparked a run on currency exchanges. Policy changes that restricted gambling and unregulated finance drained demand and liquidity in a flash. Land and virtual goods lost value as confidence slid and listings surged. The platform had to add financial rules to prevent another live meltdown.

‘Albion Online’ (2017)

Transportation and Black Market quirks let organized groups manipulate city prices and then dump stock for profit, which crashed margins across regions. A crafting return exploit amplified supply and markets slumped until hotfixes arrived. Silver sinks and tax adjustments were tuned live to slow the freefall. The game’s full loot design made each correction visible on every marketplace board.

‘Diablo II’ (2000)

Widespread duplication turned iconic rings and runes into near commodities and prices for legitimate drops cratered. Stone of Jordan counts spiraled and vendors became a reference for how distorted values had become. Ladder resets offered partial relief but the economy whipsawed whenever new bypasses appeared. Trading communities adapted by inventing verification rituals to reduce risk.

‘H1Z1’ (2015)

A refund related exploit poured rare skins into circulation and the player market nosedived as supply exploded. Listings multiplied so quickly that price trackers could not keep up with the slide. Developers rolled back portions of the economy and flagged items, which helped but did not erase the shock. Confidence returned only after multiple fixes closed loopholes.

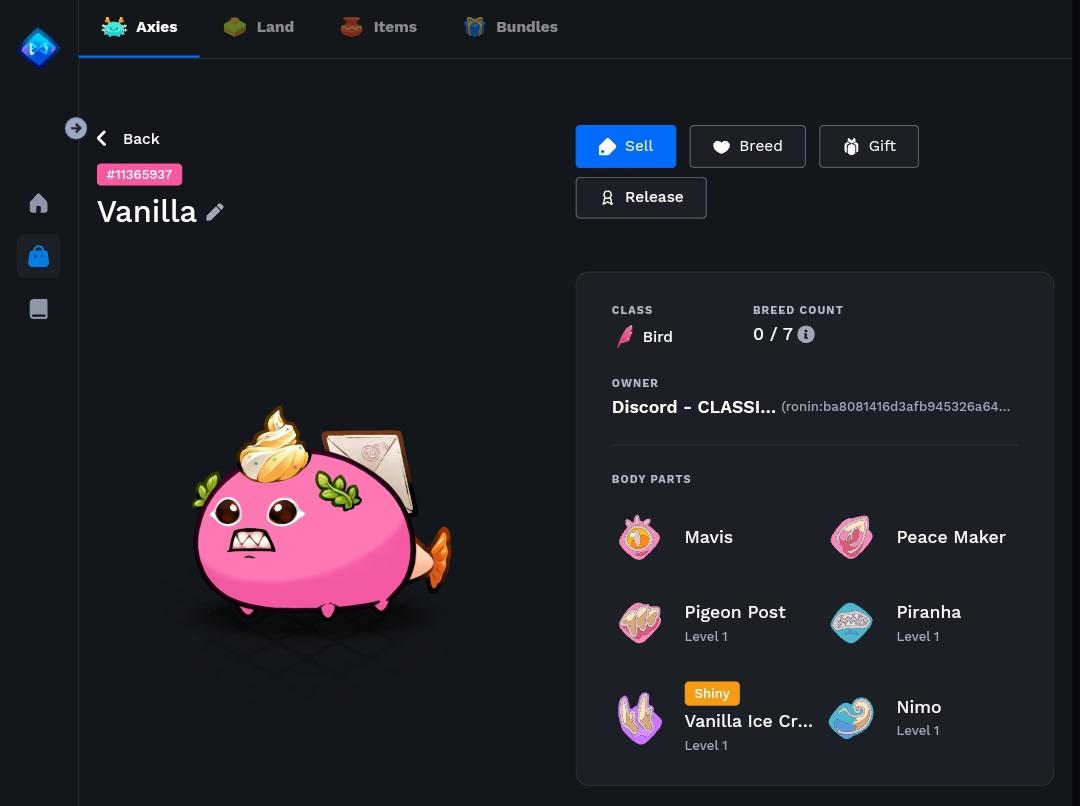

‘Axie Infinity’ (2018)

Reward emissions outpaced sinks and token values fell sharply, which erased purchasing power for in game earnings. Breeding introduced oversupply of characters and marketplace prices unwound in a matter of days. Policy tweaks tried to cut inflation, but liquidity and demand had already thinned across trading pairs. The live economy became a case study in what happens when yield incentives outrun utility.

Share the wildest economy crash you witnessed in a game in the comments.